Venture Building, what is it exactly? Venture Builders are organizations fully dedicated to launching, developing, and scaling digital startups. Venture Builders are also known as Venture Studios or Startup Studios. The venture building landscape is growing rapidly and is increasingly being recognized as a new asset class in the investment landscape.

In this article, we take a close look at the venture building landscape. What is the history of venture builders? What do venture builders do and how do they differentiate themselves from, for example, incubators, VC’s, and accelerators? What types of venture builders exist? What does the venture building landscape look like in the Netherlands? In short, all your questions about venture builders will be answered.

THE HISTORY

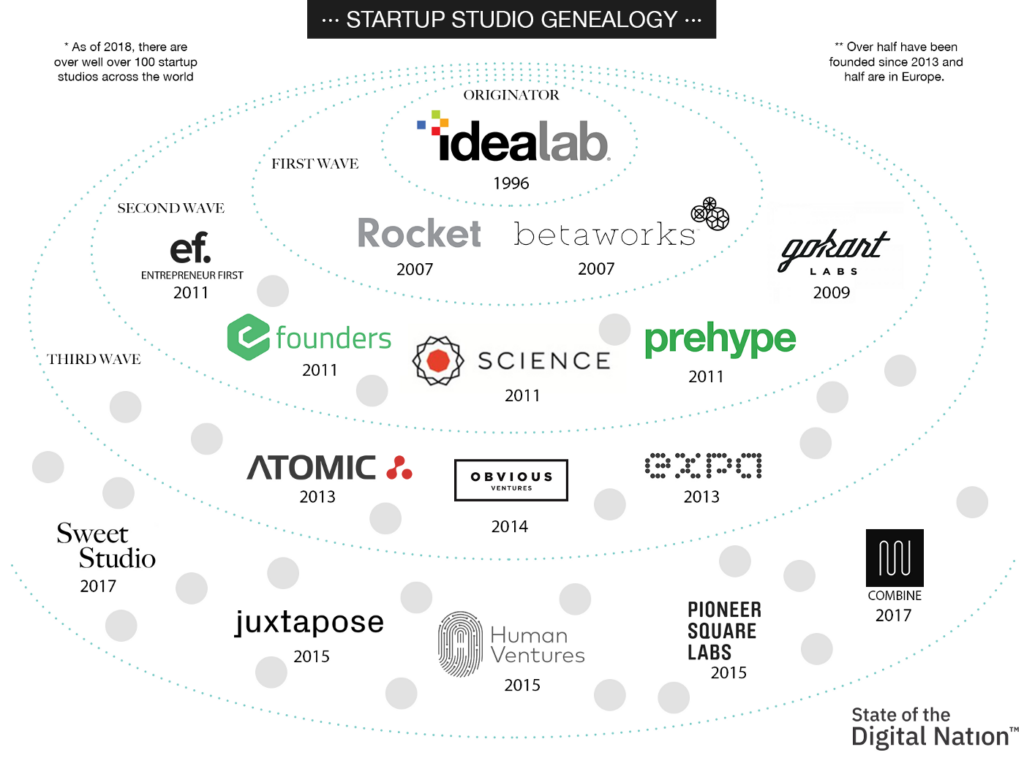

When we talk about the history of venture builders, we refer to different ‘waves’. The first venture builder was Idealab, founded in 1996. Under the leadership of Bill Gross, the company created more than 150 businesses, of which 45 have been sold or are now publicly traded. The second wave of venture builders emerged around 2007, with the founding of well-known entities like Rocket Internet and Betaworks. We are currently in the fourth wave of venture builders.

Source: The Origin and Evolution of the Startup Studio, Jules Ehrhardt

At the time of writing (November 2022), according to the Enhance Venture Studio database, there are 824 Venture Builders worldwide. Out of these 824, 50% have been launched since 2016. This indicates substantial growth. In terms of geographical distribution, we observe 282 venture builders in North America, 280 in Europe, and 86 in Asia. When zooming in on cities, New York, London, Paris, and Singapore can be considered the Venture Building hotspots.

WHAT DOES A VENTURE BUILDER DO?

A venture builder is constantly engaged in conceiving, developing, and scaling new startups. The majority of venture builders generally follow the same ‘roadmap.’ This can naturally vary per venture builder, and their ‘specialization’ can differ. At Duodeka, we follow the phases outlined below with our ventures:

- Ideation: Determine whether an internally or externally proposed venture idea for a digital startup is interesting to enter the validation phase.

- Validation: Validate both the underlying problem and the solution direction.

- Prototyping: Evolve a Proof of Concept / Minimum Viable Product and make an initial entry into the market.

- Product-Market Fit: Push into the market and work towards achieving product-market fit, which involves discovering the perfect target audience and corresponding value proposition.

- Scaling: Achieve further growth in users, revenue, and profit, enabling the startup to stand on its own.

- Exit: Carry out a (partial) exit. Later in this article, we’ll delve into the various forms of venture building.

ADVANTAGES OF VENTURE BUILDERS

In building new startups, venture builders have several advantages over traditional startups. Here are some key advantages:

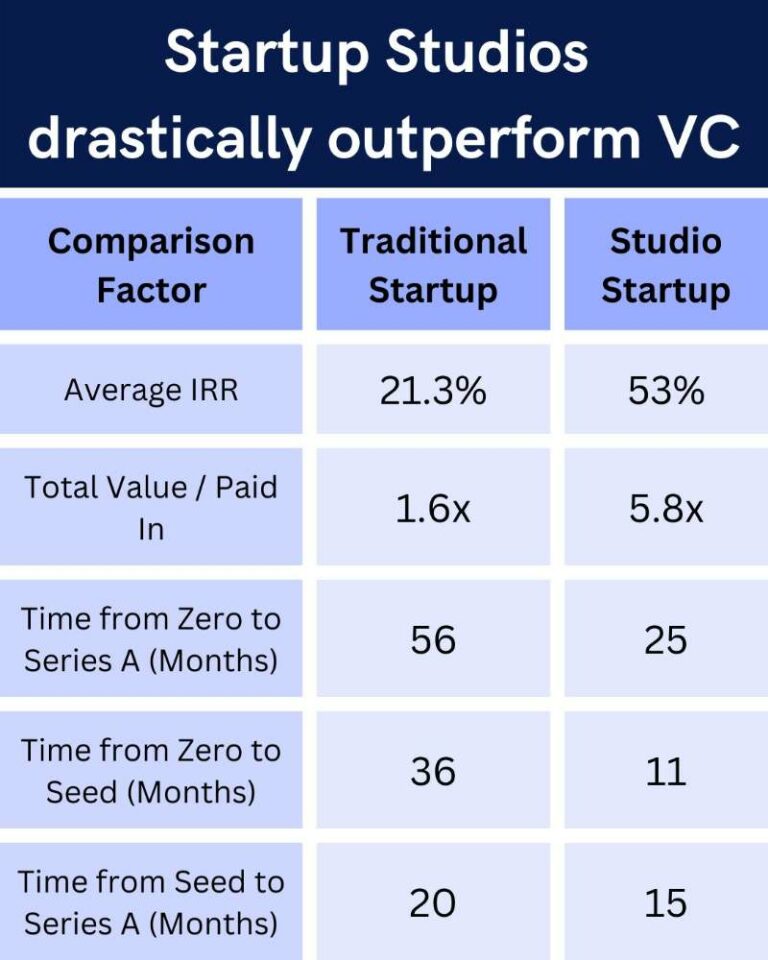

- Higher success and return ratios. The Internal Rate of Return (IRR) for companies from venture builders is reportedly around 50%, according to various studies. For single startups, the IRR is only 21%.

- Recurring experience captured in playbooks.

- Access to talent: A venture building team possesses skills that are usually hard to find.

- Flexible skill deployment: No need to hire anyone permanently. The skills of the venture building team can be brought in as needed.

- Faster market entry and exits: Time to Series A averages 25 months (1.24x faster than single startups). Time to seed round averages 11 months (2.27x faster than single startups).

- Access to manuals, resources, and processes.

- Entire team is ready to hit the ground running.

VENTURE BUILDERS IN THE LANDSCAPE

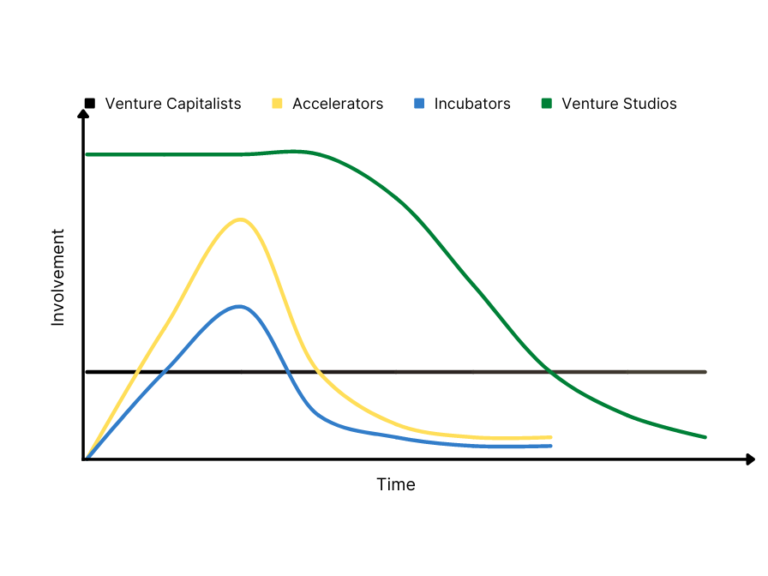

Apart from distinguishing themselves from external providers, venture builders also differentiate from accelerators, incubators, and venture capital. This difference primarily lies in a higher degree and longer duration of involvement.

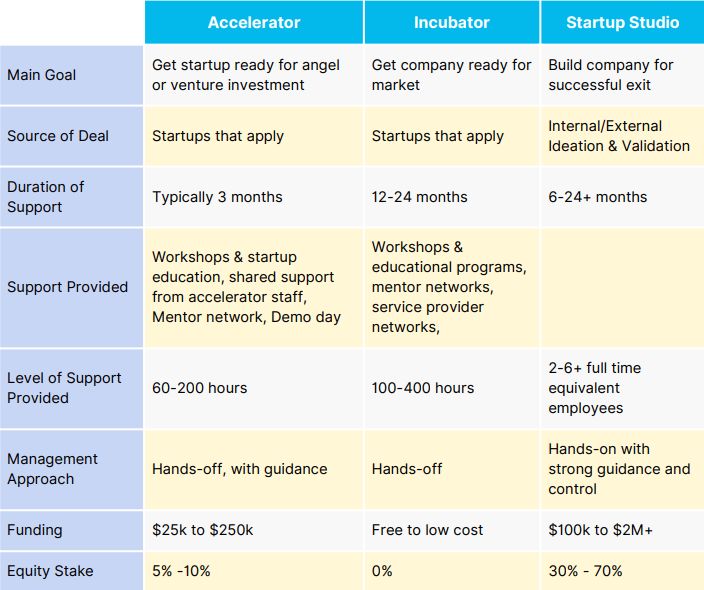

Furthermore, venture builders / startup studios differentiate themselves from accelerators and incubators in several aspects. Consider the goal, the deal source, the type of services being provided, and the equity stake. Mamazen Startup Studio and Matthew Burris have illustrated this difference very clearly in their whitepaper.

THE SPECIALIZATIONS OF VENTURE BUILDERS

IDENTIFYING BUSINESS IDEAS

A Venture Builder generates its own ideas for new businesses and brings these ideas to the market OR is approached by external individuals/parties with a business idea. Validation of the business idea will always be the starting point. This can, for instance, be conducted through the lean startup method or online concept validation. In this process, the Venture Builder needs to swiftly move from ‘nothing’ (purely the idea on paper) to ‘something’ (a means to test the idea). This might involve a Proof of Concept or Minimum Viable Product, as well as validation processes. Based on this information, the decision can be made to (1) further develop the product/idea, (2) refine the product/idea, or (3) not proceed with the product/idea.

BUILDING TEAMS

Constructing a strong team is perhaps the most crucial aspect of a Venture Builder. To get a new business idea off the ground, knowledge from various domains is required. This includes: development, marketing, sales, legal expertise, business development, and industry-specific knowledge. A Venture Builder possesses this knowledge in-house or has a vast network that can be tapped into.

ACCESS TO CAPITAL

When the decision is made to further develop a business idea, capital often becomes a concern. A Venture Builder either has capital at its disposal for developing business ideas or has a network of investors and funders that can be engaged.

LEADERSHIP

Venture Builders specialize in leading startups. This can naturally occur at different levels and stages. If the Venture Builder is the originator of the business idea, it will likely take full responsibility for daily leadership. Usually, a ‘venture lead’ is also appointed, who holds the primary responsibility for the venture. However, the Venture Builder can also operate on behalf of a partner. In such cases, the extent of leadership provided can vary, ranging from daily leadership to an advisory role.

SUPPORT THROUGH RESOURCES, TALENT, AND SERVICES

With their extensive networks, access to tools, and comprehensive knowledge, Venture Builders can support their partners across various domains. Apart from talent and access to capital, Venture Builders can also provide support through shared services. This encompasses aspects such as office space, accounting, legal counsel, etc.

All these advantages of venture builders result in a significantly higher Internal Rate of Return for startups from venture builders compared to traditional startups. The time to a Seed or Series A round is also notably shorter than that for traditional startups.

DIFFERENT TYPES OF VENTURE BUILDERS

There are different types of venture builders. Venture builders can specialize in developing startups in a specific niche, such as B2B SaaS, HealthTech, Web3, or Co-living/working.

Another way in which venture builders can differentiate themselves is in the methods they use to develop ventures. We’ll list these different methods. Some venture builders operate according to only one of the methods below, while others offer multiple options.

- In-house venture building: Ideas for new ventures are conceived and validated in-house. Subsequently, an internal venture lead is appointed, a venture lead is hired, or collaboration is sought with an external individual (or party) who will participate in the venture.

- Joint venture building: A venture builder starts a new venture together with a co-founder (external entrepreneur or party).

- Corporate venture building: A venture builder is part of a larger corporate entity that finances the venture builder (and typically develops ventures in the interest of the corporate).

- Late founder venture building: A venture builder joins an existing team with a product to continue its development.

EQUITY STRATEGIES OF VENTURE BUILDERS

Venture Builders differ in many dimensions from each other. Think of industry focus, number of startups, internal or external ideation, the amount of equity in the ventures, etc. Why would a venture builder go for a lot of equity? Or why would they go for little equity?

Responsibility. When a venture builder holds a majority stake in a startup, they are expected to take on a more hands-on role and be responsible for a greater share of the work. Conversely, with a smaller amount of equity, the venture builder may take on a more limited role as a strategic investor or focus on a specific area of expertise.

Volume. As the amount of equity increases, the venture builder spends more time on the startup. Time is scarce, so venture builders with a lot of equity typically participate in a lower number of startups. When going for a higher volume, the venture builder will compensate for that with less equity.

Exits. When you have more equity in a startup, there is more to be earned at exits and more can be diluted. With less equity, the exits are lower, but chances can be spread over more startups.

Cross-pollination. With more equity, you are more operationally involved in the ventures, which allows you to learn more valuable lessons in that area. When you only have a small stake in a venture as a strategic investor, you will miss out on these lessons.

Of course, there are other factors that influence the amount of equity. Think of in-house vs. joint and early vs. late stage investment.

WHY VENTURE BUILDERS ARE SUCCESSFUL IN THE STARTUP LANDSCAPE

Venture Builders distinguish themselves in the startup landscape by achieving a significantly lower failure rate than ‘regular’ startups. From a study involving qualitative interviews, three pillars have been identified through which venture builders achieve this.

The kill rate of venture builders is quite high. A stringent validation process ensures that many ideas are halted in the early stages. This leaves only the ideas with truly high potential. Access to talent specialized in building new businesses, combined with access to capital, contributes to the exceptional performance of venture builders in the early stages. Due to achieving above-average success rates and returns, venture builders find it easier to secure investments. This results in growth capital being less frequently an issue. Venture builders manage to secure Seed investments over three times faster. Series A investments are also obtained twice as quickly.

VENTURE BUILDERS IN THE NETHERLANDS

Venture building in the Netherlands is still in its early stages. Currently, the venture building landscape includes the following studios:

- Duodeka (B2B SaaS)

- Builders (co-working & living)

- Entweder (office innocation)

- Brainblurb

- Fresh Venture Studio (circular food systems)

- Aimforthemoon (corporate venture building)

- Tes Ventures (impact-driven)

- The main ingredient Nescio (tech)

DUODEKA AS VENTURE BUILDER

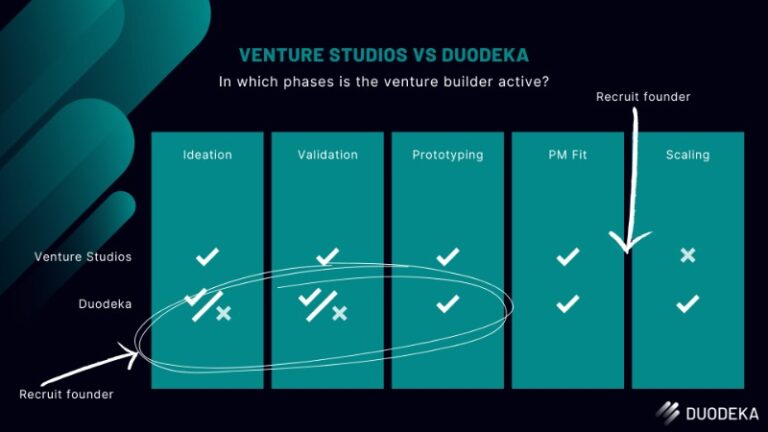

Duodeka is also a Venture Builder. In the visual below, you can see how Duodeka compares to other venture builders.